Students save money by budgeting

Spending money is an issue most students have even if you qualify for financial aid. According to Scholarship America, 70 percent of college students reported feeling stressed about their finances.

Nearly 60 percent of respondents reported that they were worried about having enough money to pay for school and half were worried about paying for their monthly expenses. But with money, there is a responsibility in budgeting how to spend that money.

Associate professor and director of school of accounting, financial and information services, Dr. Arturo Rodriguez, said he advises students to prioritize what they spend their money on.

“The biggest problem students have regardless of how much money they make is the decisions they make with that money,” Rodriguez said. “The two questions a student should always consider before making any purchase is: Do I need it or do I want it? How quickly do I need it?”

Most students can’t remember when they considered those things before going out to eat or buying a new pair of shoes. According to Rodriguez, just taking a moment to assess what you are spending money on can save you big bucks.

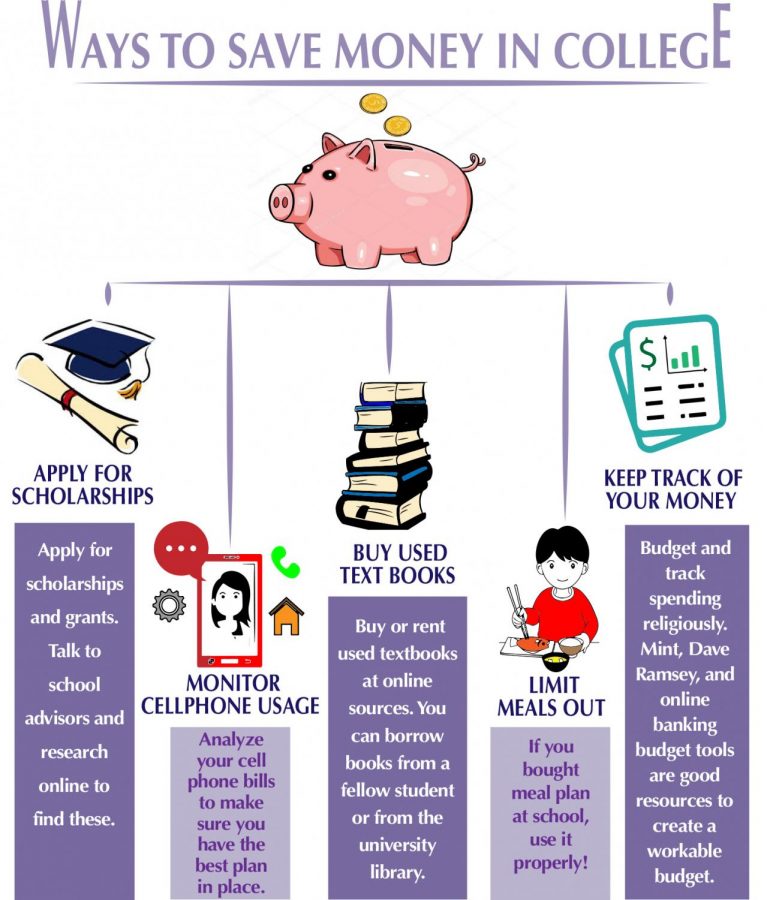

Rodriguez also said that students should develop a habit of budgeting.

First, students should consider how much comes into their account versus how much they spend and how much they will have to save at the end of the day. This way they will be able to account for all of their bank transactions.

Senior medical laboratory science major, Bipana Khadka, said that the best thing she did when it comes to managing her financial resources was to reduce how often she shopped online. Although sites like Amazon often have great deals, people can lose track of how much they are spending. Khadka also monitors her credit card transactions so she does not end up in extraneous debt. Another thing Khadka practices is responsible spending.

“The main thing is to study right now, so students should avoid unnecessary spending because once you start spending, you will end up spending a lot,” Khadka said.

Two pre-pharmacy freshmen Holley McInnis and Ally Trahan have experienced similar financial struggles since the beginning of college.

They both agreed that not finding a job has posed serious challenges for them. It has made them more dependent on their parents to supplement their dwindling funds. This issue has worsened by the price of textbooks and other learning aids required by professors. McInnis and Trahan said that students should adopt a habit of eating out less and try to rent books online instead of buying new ones.