Investing can be too difficult for some

College students are known for being broke. We scrounge up just enough money to get some ramen or a four for $4 from McDonald’s.

We take the cheapest way to do things so we don’t spend what little money we have. So, how do our parents expect us to invest money?

Last week I was having a conversation with my parents about investing. They mentioned how important it is to invest at a young age and how they wish they would’ve done it.

It’s something I’ve thought about doing but I just don’t have the money for it. I’ve always saved my money, but I’ve never invested it.

For those of you who don’t know, saving is just putting money aside for emergencies or something specific.

Investing is trying to make your money grow by buying things that could increase in value like stocks, property or shares, according to the Money Advice Service.

While it is important to try to grow your money, for many this isn’t an option.

We have to pay for car insurance, gas, food, electric bills and so many more expenses. And to add on top of all that, we are in school trying to pay for books and tuition.

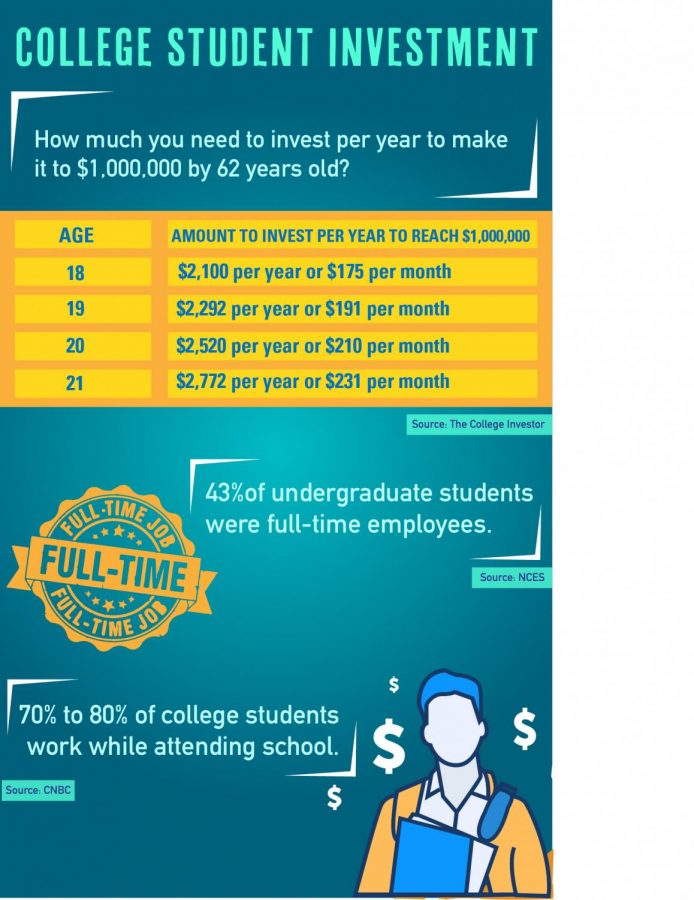

According to CNBC, about 70% to 80% of college students work while attending school. Most of that money goes to paying for school or your apartment.

And investing isn’t cheap. According to the College Investor, to reach $1,000,000 by the age of 62, those between the ages of 18-21 must invest $175-$231 per month. I don’t know about you, but for me that’s almost a whole paycheck.

Don’t get me wrong. If I had the money I would invest. But for college students, it’s really not an option.

According to NCES, 43% of full-time undergraduate students in 2017 were also employed.

Plus, most of us make minimum wage. It would be easier to invest once you are out of college because not only will you have a full-time job but you also won’t be paid minimum wage.

Instead of trying to figure out how to invest your money, learn ways to save your money. If you save your money, you will have it in case little emergencies pop up or if you decide you want to be adventurous and go on a trip.

It is true that the earlier you start investing, the more time your money has to grow.

But you’re young. Live your life. Go places and do things with your money that you won’t be able to once you get older and have kids.Experiences and adventures are worth working a few extra years to retire.

Maybe you are interested in investing, but don’t fully understand it. Use this time in college to learn about it.

Spend some time figuring out what it’s all about before you step into something you don’t understand.

And if you want to do it now and happen to have the money, then go for it. For those who don’t have the money and feel pressured by family members to invest, don’t do it.

Take your time. Do it only if you think it is right for you.

As a college student, you have enough to worry about right now. Don’t stress yourself out about the future.