Students can increase their money by investing

Saving leads to opportunity, bigger budget for future expenses

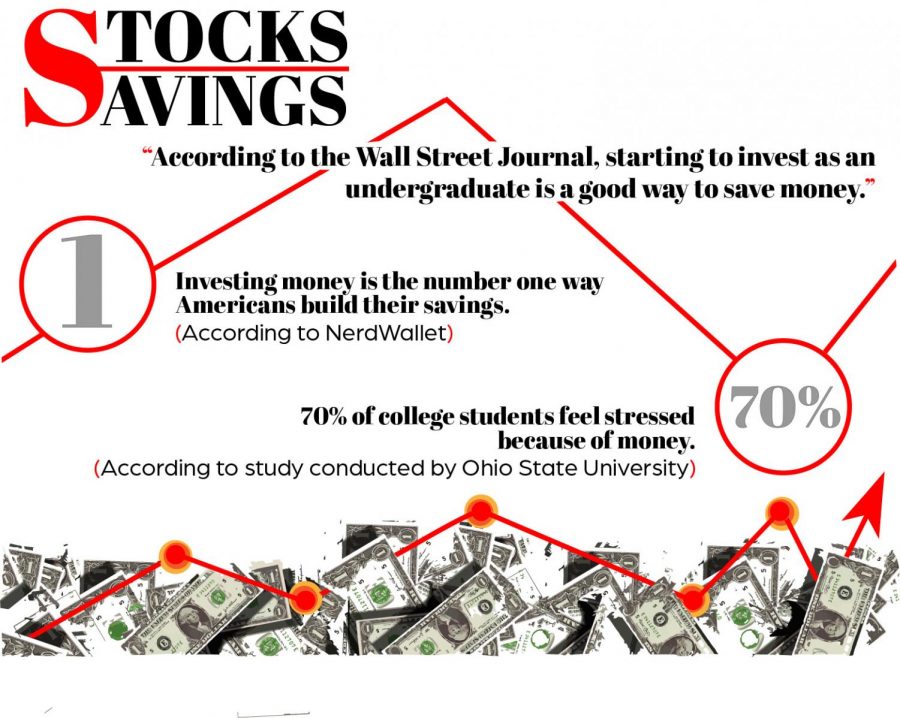

For most students, the words “investment” and “savings” seem impossible because every penny counts when you are living proof of the stereotype “broke college student.” However, investing can actually help a student defy said stereotype.

Dr. Arturo Rodriguez, the director of the School of Accounting, Finance and Information services, advises students in his courses to start investing and saving early so they have “a longer timeline to put money away” for things like retirement.

“In the rare case where a college student has a bit of spare money, then the question becomes ‘What is the objective?’,” Rodriguez said.

Students need to consider what they believe an investment is. According to Rodriguez, an investment is something that has the potential to make money in the future. Yet, college students are afraid of losing money and would rather spend than invest. For a majority of college students, that fear is what hinders them from growing or saving their money.

Queen Bolden, a sophomore radiologic technology major, said she doesn’t see how students could invest even if they wanted to.

“As a student, you need to be saving your money not spending it on an investment you really know nothing about,” Bolden said.

Another student, Cassie Johnson, said she believes students don’t attempt to invest their money, because they don’t understand that the process is not “quick money.”

“You do make money but it is accumulated. It takes years of practice and learning to actually master the stock market exchange,” said Johnson, a junior accounting major.

Rodriguez said the key to a successful investment is putting your money in multiple companies, which is called diversifying.

“As a result, even though some investment does really badly, the ones that do well will offset the bad ones and we will not lose our investment,” Rodriguez said.

For students who want to diversify their investments, there are phone apps that help choose different companies to invest in. One app, Acorn, rounds up every purchase you make and saves the added value to a savings account or investment of your choice. Another app, Robin Hood, allows you to put your money in stocks conveniently.

Johnson also provided an alternative for students who are not interested in traditional investments. She said she uses online banks since they have a higher interest rate.

“Goldman-Sachs Bank USA Online Savings is one of the online banks I am currently interested in since their interest rate is 1.70%,” Johnson said.