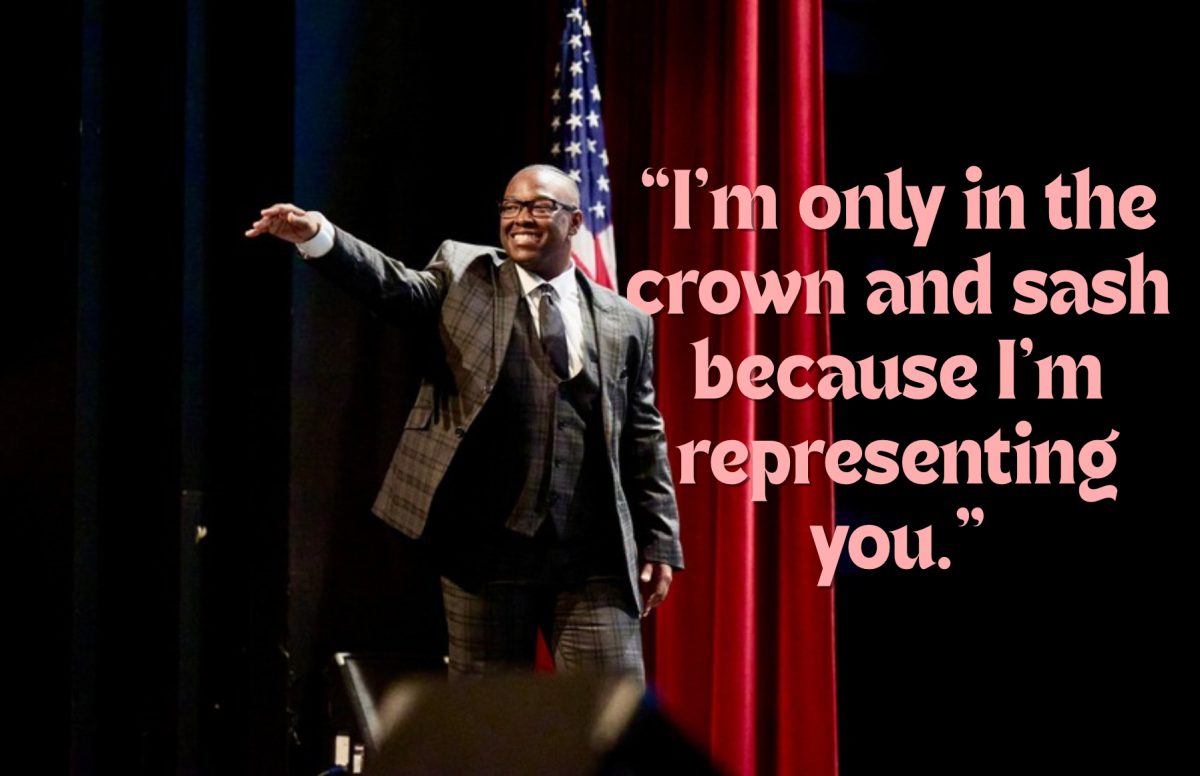

When Mason Howard hears student loans he imagines canes reaching out to pull someone off the stage. A cane being around your neck.

When Mason Howard hears student loans he imagines canes reaching out to pull someone off the stage. A cane being around your neck.

Howard has been able to avoid taking out student loans by using Pell Grants and TOPs. Howard also receives a talent grant from the marching band.

“I’ve come close a couple of times of needing to, but I’ve managed not too so far,” said Howard, a junior musical education major.

When it comes to student loans, Howard doesn’t feel intimidated or fearful but rather feels a sense of non-necessity.

“If you don’t need it, you might as well not bother it,” said Howard. “I feel like a lot of people take out a loan without considering whether they can actually pay it back.

Student loan debt in America totals 1.1 trillion whereas credit card debt totals 650 billion. Howard isn’t surprised about this.

“It makes sense because a lot of people just take out a loan absent mindedly,” said Howard.

Howard said he believed that many grow used to the temporary relief and ignore the fact that the loan will have to be returned.

Howard said he thinks that some students will go to a more expensive school just to please a family member, even if the student could afford a cheaper school without any loans.

“It’s an expectations thing,” said Howard. “Sometimes they feel like they need to be the best of the best and not worry too much about the money situation.”

Howard said he thinks the state and federal government should do more to ensure that people don’t have to “dig out a loan.”

“I don’t know how they would do it but it would definitely help. I feel like the truth is that government is going to do what they want to do with the money they have and it’s their choice,” said Howard.

Though Howard is able to afford school and doesn’t live on campus, he feels book prices are too high and should be lowered.

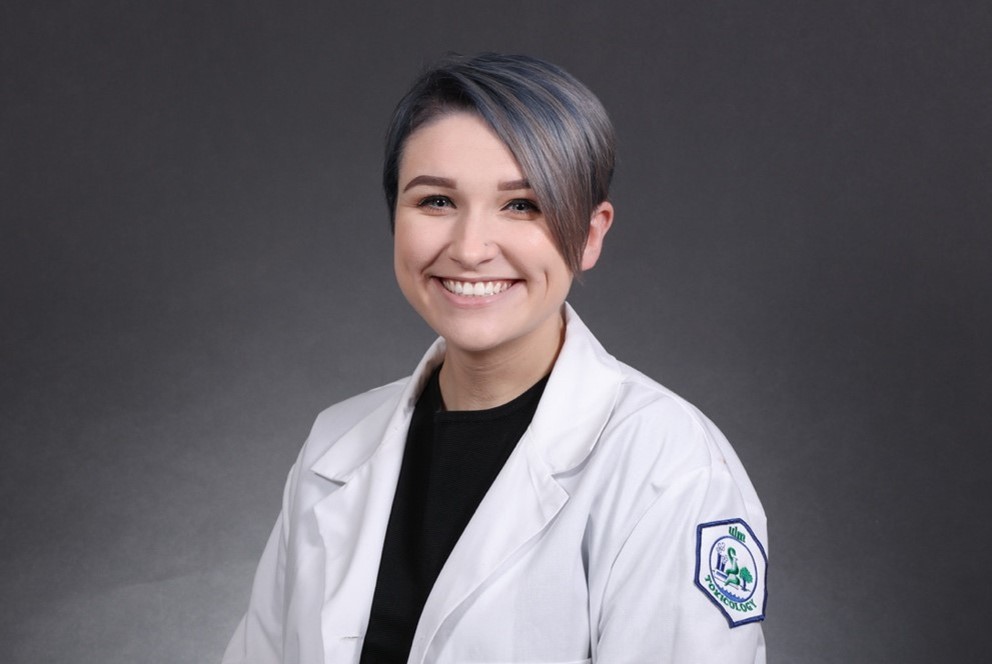

Miracle Lain was not as lucky as Howard.

“After TOPs and my Pell Grant I still owed the school some money and needed to buy books. So I took out a loan,” said Lain, a sophomore English major.

Lain feels that although she is a student with debt, the thought of owing someone anything makes her feel trapped.

“I’m terrified. It’s scary that I have loans hanging over my head. Especially when I question whether or not I should continue school,” Lain said.

Lain believes that the cost of education should be lowered. While she does not feel that higher education is impossible to achieve in America, Lain does feel that it is more difficult for students who don’t have college funds set up early on.

“If I were more cynical and bitter I would say that it’s all a government conspiracy to promote education as a privilege for the wealthy,” Lain said.

Student debt has climbed 58 percent since 2005. One-third of millennial age college graduates will say that it is more affordable to go to work than attend college, according to Forbes Magazine.