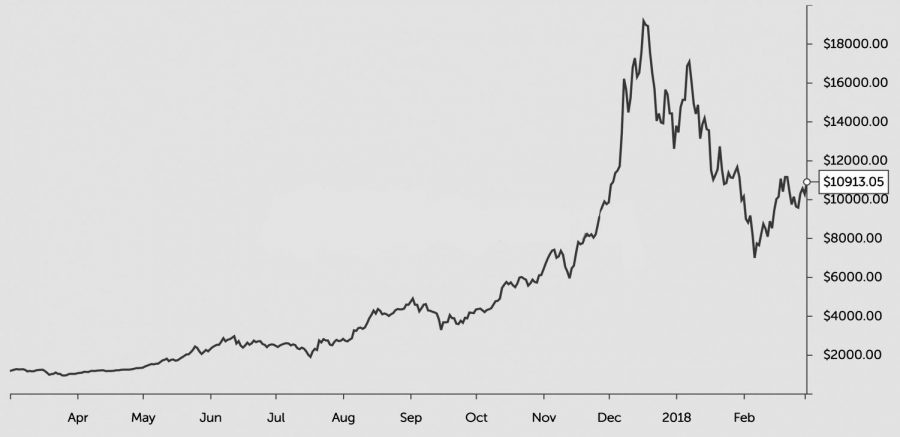

Bitcoin prices drastically fluctuate

March 5, 2018

In the world of virtual currency, Bitcoin has led many conversations.

However, Bitcoin has recently been on a rollercoaster of uncertainty.

The cryptocurrency’s price hit a record amount of $19,850, then dropped to a substantial $6,000 from mid-December to the first week of February.

It has since been on a steady rise with a current price of $11,000 as March has rolled in.

“It is mined by creating blocks of validating transactions and including them on the blockchain. At first, Bitcoin was the only one to use this system, but now anyone can create their cryptocurrency with the help of this system,” computer science professor Jose Cordova said.

Bitcoin mining is the process of making hidden bitcoins visible to the block chain by solving difficult puzzles through recent transactions.

“So, people, instead of buying these Bitcoins started making their own currencies which is why its value isn’t rising like before,” Cordova said.

The cryptocurrency is solely based on the belief that is has value, therefore it’s not regulated by the government.

“I will never invest in such things that do not have any financial backing. Its fluctuating values makes things even worse. It does not have any financial backing, nor is it related to any state or government. There is absolutely no one to hold responsible if something goes wrong,” MBA graduate student Rajan Bhattarai said.

People have found that Bitcoin has a lack of immunity against attacks.

Its decentralized financial network has already been attacked numerous times and is in danger of experiencing more. It doesn’t have a central bank and is not linked to any state, which makes the investors feel even more vulnerable to cyberattacks.

“Bitcoin has a long way to go,” MBA graduate student Avash Pokharel said.

Pokharel has invested and made a fairly good profit on Bitcoin.

“One of the major reasons of Bitcoin’s fall is due to the banking sector. They don’t want cryptocurrencies to gain value,” Pokharel added.

Both banking and non-banking sectors are at the risk of technological disturbances in payment processing and other services.

So, if the cryptocurrencies such as Bitcoin take over the financial world, no intermediation is needed for banking services which result in significant loss for these banks.

The rumor that banks are against the virtual currency system may be true.

CEO of JPMorgan Chase, Jamie Dimon labeled Bitcoin a “fraud.”