Tax filing vital for international students’ future

March 9, 2020

International students are expected to file taxes every year just like students who are citizens of the United States.

Tax filing is a topic that can be confusing for everyone. However, the process is often even more confusing if you are not from the United States.

DeVaria Ponton, the international services program director, said that correctly filing taxes is important for international students’ futures as they continue to study abroad.

“International students have a tax obligation whether they earned taxable income or not,” Ponton said. “Filing your tax forms and filing them correctly is very important.”

Failure to file taxes or mistakes in tax filings can result in penalties, interest charges or an IRS audit for citizens and international students. However, tax mistakes can also negatively impact an international students’ visa and status requests in the country.

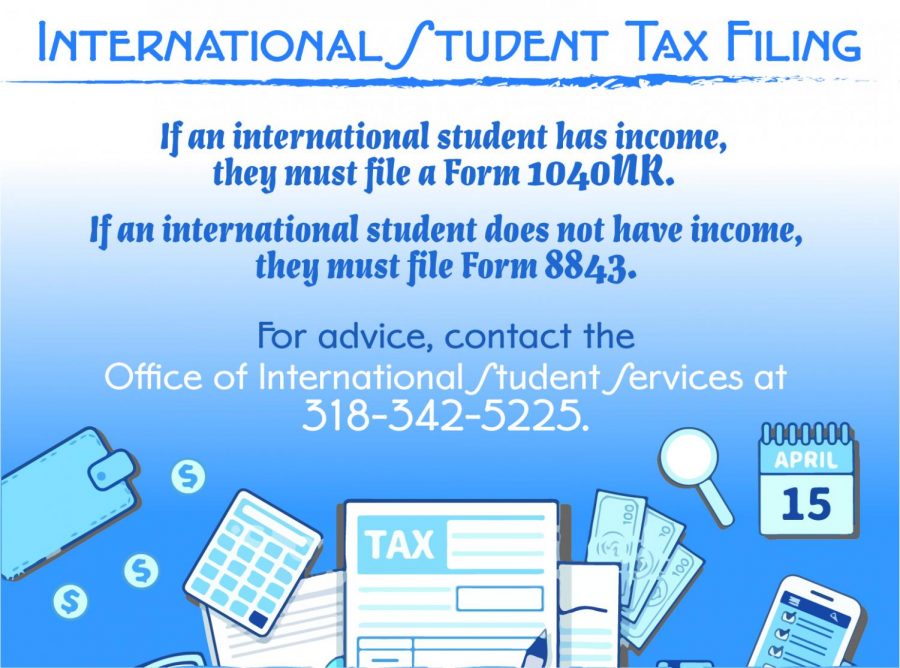

If an international student earned taxable income, then the student must file Form 1040NR, according to Ponton. It is recommended that international students avoid using TurboTax or similar websites because those platforms do not provide the correct tax form.

Some international students may not have worked during this period. Those students do not have to file a tax return since they did not make any income that could be taxed. Instead, students without any income must file Form 8843 which is an informational statement required by the U.S. government for nonresidential people living in the country, according to Ponton.

If an international student is struggling with their taxes, the International Student Office not only informs the students about the core information they need to maintain their student status, but they also provide resources to help students file their taxes with as little stress as possible.

To help international students through the process as much as possible, Ponton said the International Student Services purchases a limited number of tax licenses from Sprintax every year. Then, they will host workshops where officials aid the students in filing their taxes.

“The International Student Services team are not trained in taxation and therefore cannot assist students with filing taxes,” Ponton said. “However, we want to make sure that international students have the tools to meet their tax filing obligations. This year we partnered with the ULM VITA chapter.”

Two workshops were offered in February 2020 for international students to have one-on-one tax filing assistance provided by VITA. Additionally, at the workshops, the International Office provided pre-printed envelopes and stamps for students to mail their returns.